Explosive documents reveal that New York Attorney General Letitia James illegally obtained a federal loan in 2011 by marring her own father as part of a twisted mortgage fraud scheme.

The damning evidence shows James refinanced her Brooklyn apartment building under the HAMP program, claiming it had just four units. But the official Certificate of Occupancy tells a different story: the Lafayette Avenue property actually boasts five apartments.

BYPASS THE CENSORS

Sign up to get unfiltered news delivered straight to your inbox.

You can unsubscribe any time. By subscribing you agree to our Terms of Use

That lie scored her a 2.7% government-backed loan, a deal reserved for landlords with four units or fewer. On top of that, James cried financial hardship to seal the deal, despite raking in over $126,390 in 2011.

Trump Insider: ‘Enemy Combatant’ Anthony Fauci Faces Military Tribunal at GITMO

But the plot thickens. A pattern of shady dealings emerges as fresh questions swirl around a home James bought with her father, Robert James, raising eyebrows about whether their relationship—and their real estate moves—crossed lines far beyond the law.

Thegatewaypundit.com reports: In the Spring of 1983, Letitia James was 24 and living in Brooklyn with her parents. She had graduated from CUNY’s Lehman College in 1981. She would not begin law school at Howard University in Washington, DC, until the fall of 1984.

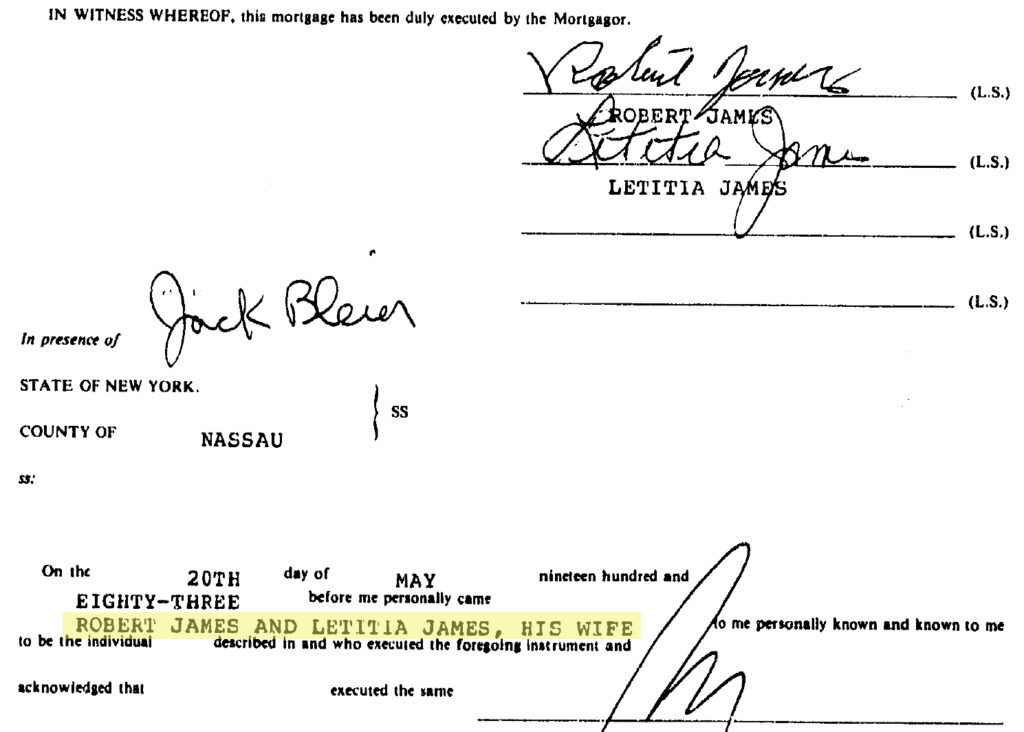

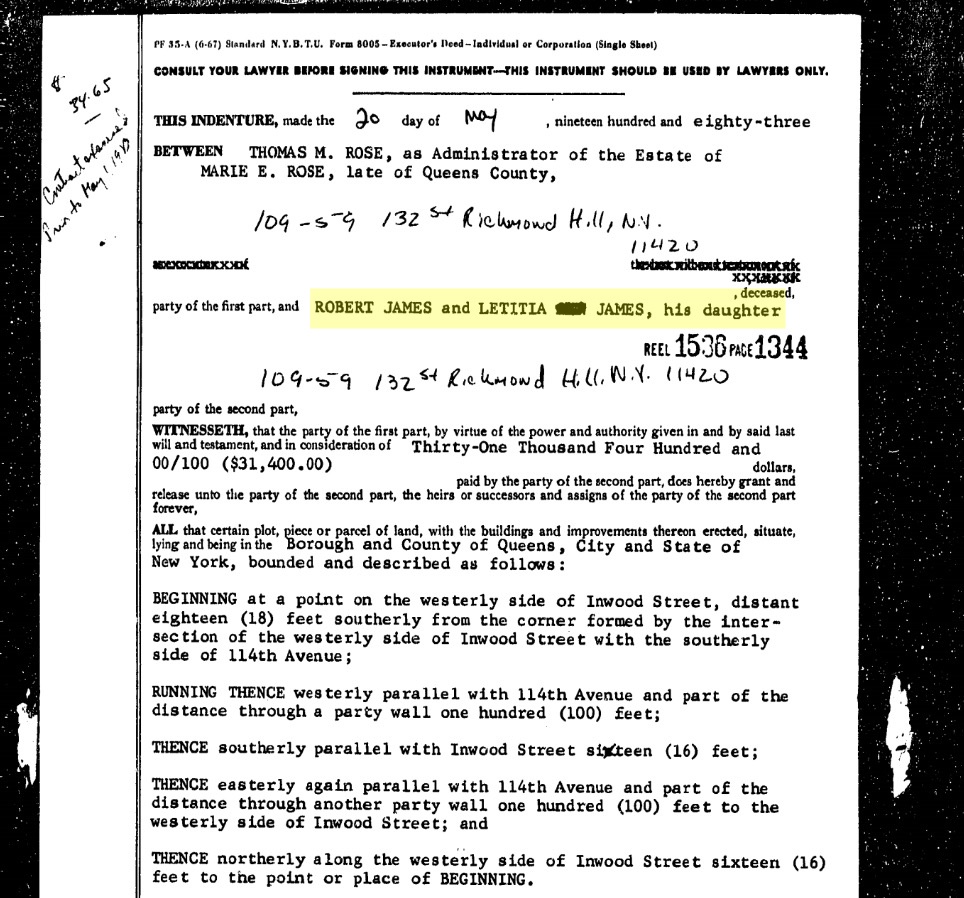

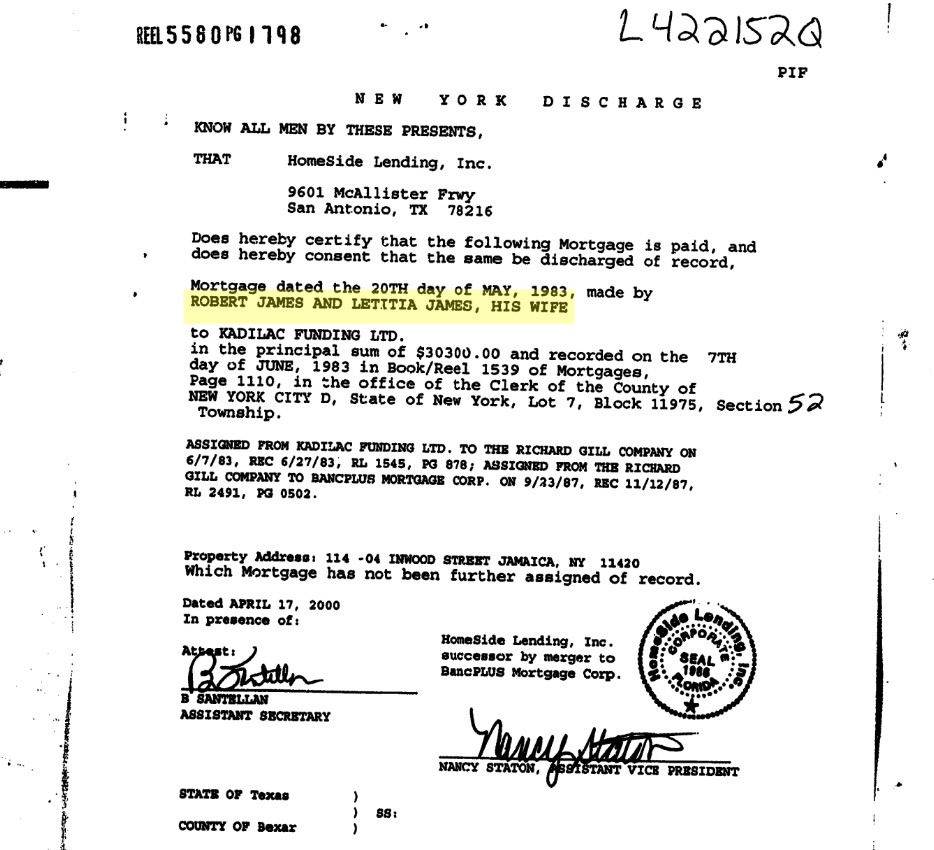

According to New York City Department of Finance records, on May 20, 1983, Letitia James and her father, Robert James, took out a real estate loan from Kadilac Funding Ltd. for $30,300 as “husband and wife.” For the record, Letitia James’ mother is Nellie James.

The husband-and-wife designation is clear and in capital letters on the very top of the first page of the loan document and on the signature page, which reads “ROBERT JAMES AND LETITIA JAMES, HIS WIFE.”

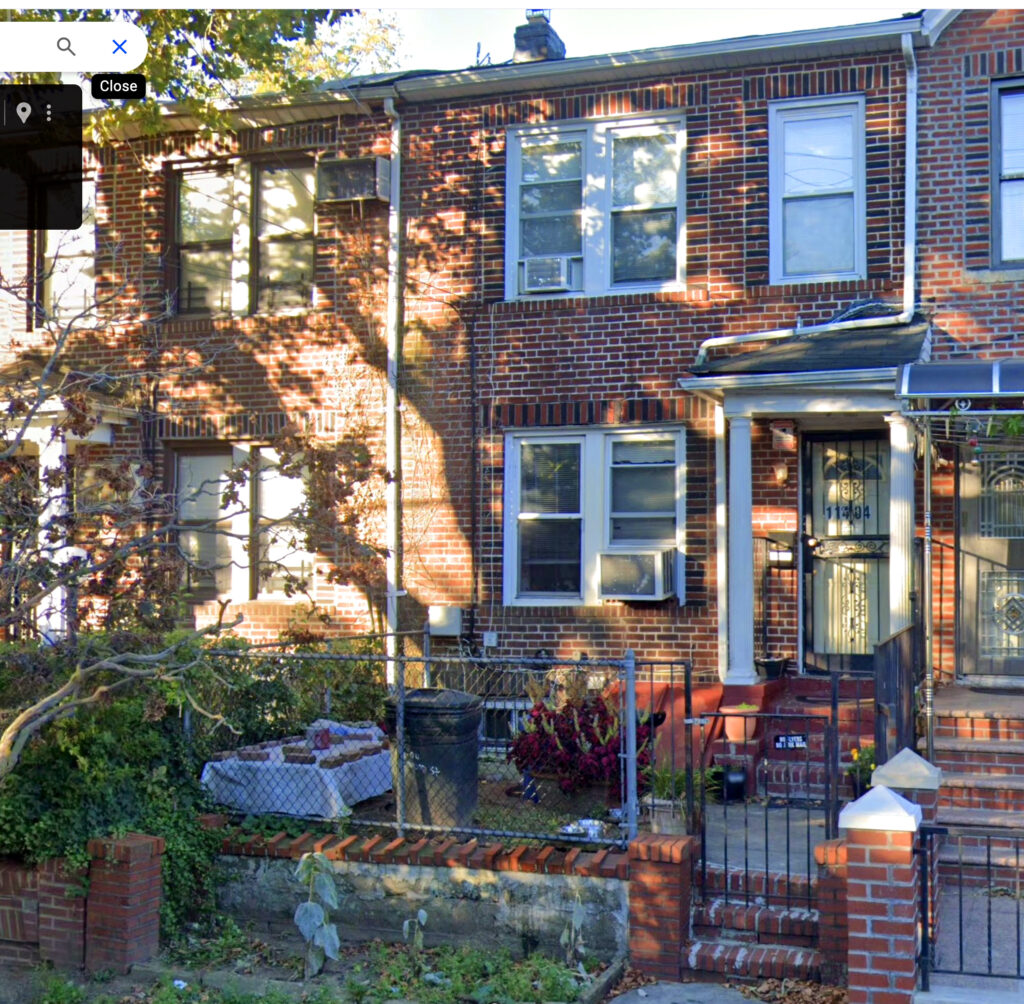

This loan was used to purchase a small 888-square-foot two-story home at 114-04 Inwood Street in Queens, New York, likely for Letitia to live in.

Meanwhile, the deed for the property, executed on the same day, has a different designation. On the top, it says the property is being purchased by “ROBERT JAMES AND LETITIA JAMES, his daughter.”

At the age of 24, Letitia James may have had trouble qualifying for a home loan as a single woman with little or no income.

The question for Ms. James is whether she and her father defrauded the mortgage company, Kadilac Funding, by pretending to be husband and wife in order to qualify for the loan.

The less likely alternative is that Letitia actually married her father. In this case, she would have been telling the truth both on the mortgage and on the deed—father/ daughter/ father/ daughter—shades of Chinatown, but the marriage would have been fraudulent. What is true is that Letitia has not married anyone else in the years since.

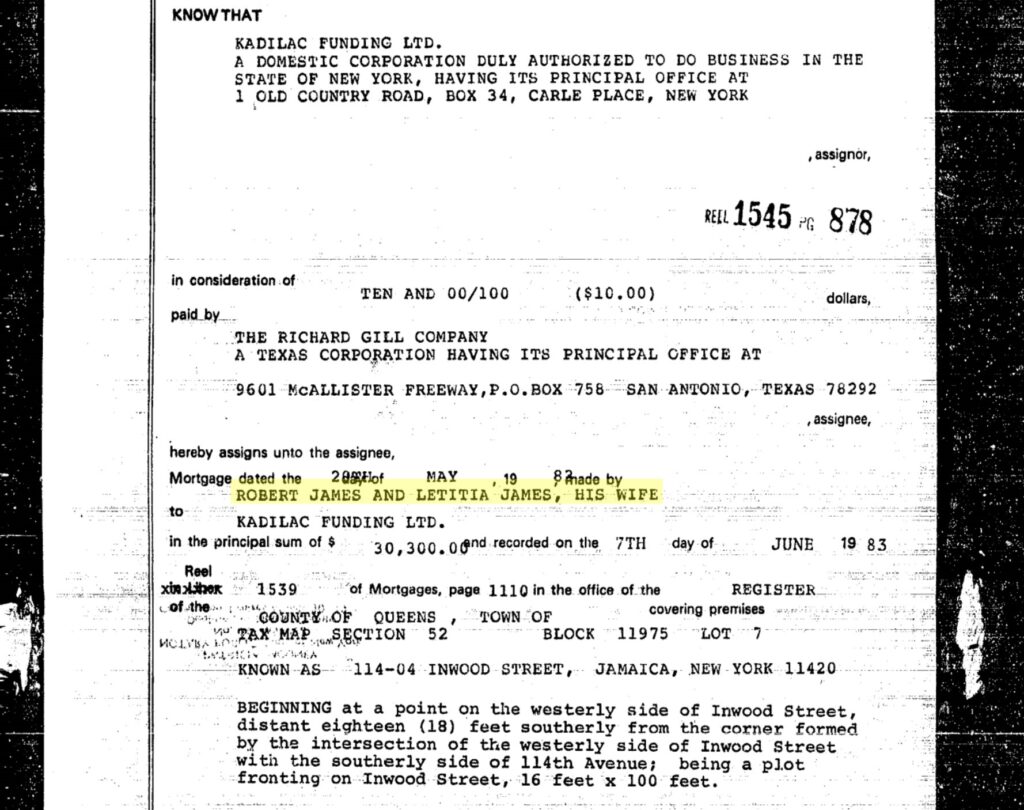

When the James couple’s loan was assigned by Kadilac Funding Ltd to The Richard Grill Company and recorded on June 27, 1983, Letitia and her father, Robert James, are once again listed as “husband and wife.”

Finally, when Letitia sold 114-04 Inwood Street on May 4, 2000, the document listed the sellers as “ROBERT JAMES AND LETITIA JAMES, HIS WIFE.”

It is illegal for a father and daughter to falsely represent themselves as husband and wife to obtain a mortgage loan. This would constitute mortgage fraud, which is a serious offense under federal and state laws.

Mortgage fraud can include “False Representation,” defined as “providing misleading or false information on a loan application” and “Misrepresentation of Relationship,” defined as “lying about marital status to qualify for better loan terms.”

Penalties for mortgage fraud can include fines, civil lawsuits, criminal charges, and even imprisonment.

In February 2024, James led a high-profile fraud case against Donald Trump. In her relentless pursuit of Trump, James has denied herself any easy excuses. She offered Trump no benefit of the doubt and disregarded the lack of an injured party.

Playing hardball, James secured a massive a judgment that found Trump and his company guilty of inflating asset values to secure better financial terms.

During her victory speech, James declared: “When powerful people cheat to get better loans, it comes at the expense of honest and hardworking people.

Everyday Americans cannot lie to a bank to get a mortgage to buy a home, and if they did, our government would throw the book at them. No matter how big, rich, or powerful you think you are, no one is above the law.”

The hypocrisy here is breathtaking. If my read of the records is accurate, James lied multiple times to secure favorable loan terms at the “expense of honest and hardworking people.”

One wonders whether New York State will hold James to the same legal standards she applied to President Trump. After all, as James has assured us, “No one is above the law.”